Scan to Pay

Allow your customers to scan a QR code to pay for purchases using their smartphone.

Overview

Free

PocketPOS

Designed for fast-paced business environments where being mobile is a must.

Overview

R499*

For lower transaction volumes

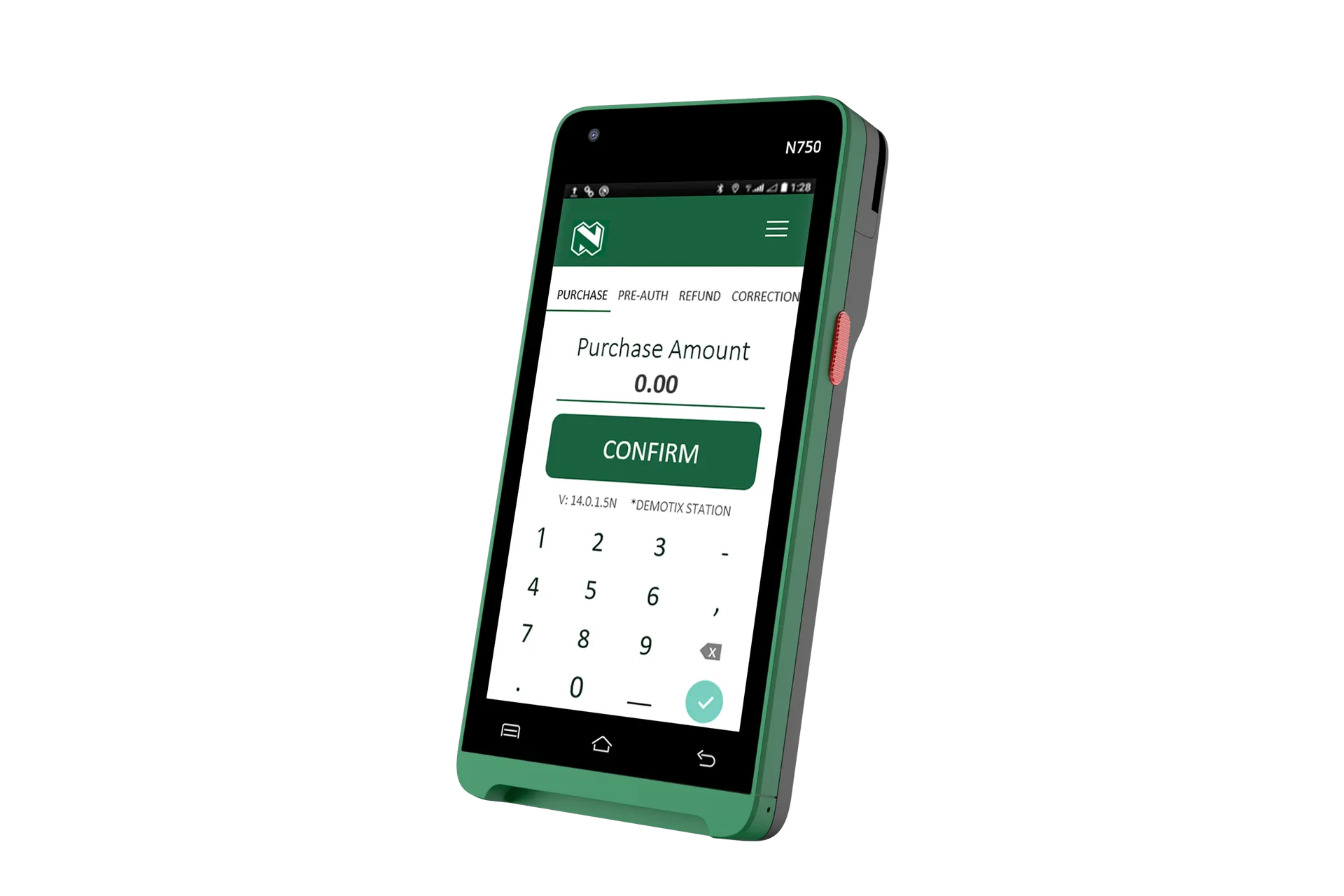

Android POS

Get a compact, lightweight and easy to move device.

Overview

R1299*

Android POS

Print receipts quickly and efficiently with this compact, lightweight and easy to move device.

Overview

R1699*

* Earn back the value of your device cost.

To earn back the rebate into your account when you accept more payments, your average value of transactions processed via the device must be consistent over the first 3 months after purchasing the POS device. Terms and conditions apply.

|

|

PocketPOS |

Android POS |

|---|---|---|

R4 250 to R8 500 |

R13 750 to R27 500 |

|

R8 500 to R17 000 |

R27 500 to R55 000 |

|

Accept over R17 000 |

Accept over R55 000 |

For higher transaction volumes

Desktop POS

Accept card payments at your fixed location with Desktop POS.

Overview

Tailored

Portable POS

Perfect for all your mobile card-acceptance needs.

Overview

Tailored

GAP Access (Merchant cash advance)

As a point-of-sale (POS) user, you can get a cash advance with flexible repayment terms. You can qualify for between R30,000 and R1,5 million, depending on the turnover through your POS device. Repayments occur daily and are paid back as an agreed percentage of your card POS transactions over six or nine months.

Merchant services for more complex needs

We offer bespoke payment solutions, from hybrid models to fully integrated offerings, covering everything from e-commerce to till software integration. Connect with our dedicated sales team, who are well-equipped to present a tailored proposal aligned with your specific needs.

Need more info? Talk to us.

Call me backJoin Small Business Services

Use the Money app

A secure and convenient way to manage your business and personal profiles all in one place.

Learn more about the app Learn more